Periodic evaluations allow companies to adapt controls to evolving business needs and regulatory requirements. Leveraging automated inventory management systems enhances control measures by providing accurate and timely data, reducing the likelihood of human error. Accurate inventory recording also impacts cost of goods sold (COGS), a key income statement component.

Get in touch with an expert. Talk with sales.

But another issue is the goods in transit valuation which we need to recognize in our balance sheet. We need to account for shipping, insurance, Freight in, transportation fees into the inventory valuation. The problem is should we accrue costs with inventory in transit or wait until they arrive. For example, company ABC purchases $ 10,000 of raw materials from oversea on 01 June 202X.

How to Calculate Inventory In-Transit Costs

- You can take a huge load off your shoulders by outsourcing fulfillment and warehousing to a 3PL like ShipBob.

- Under Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS), the timing of this transfer significantly impacts financial reporting.

- Errors in accounting for goods in transit can distort COGS and affect gross profit margins.

- Here, ABC Inc. is the dealer and XYZ Inc. is the buyer, however, the terms of conveyance have been changed to FOB destination, and the shipment still has to arrive at XYZ Inc.’s.

- From a practical point of view, the buyer might not record the goods in transit until they arrive at the destination.

Detailed sales reports and regular audits are crucial to ensure that all sales are accurately recorded and revenue is recognized in a timely manner. When goods are in transit, they represent an asset that must be accurately reflected in the financial records. Mismanagement or misreporting of these assets can lead to distorted financial health indicators, which can mislead stakeholders and investors. In-transit inventory refers to items that have been shipped but have not yet arrived at the destination. The accounting for in-transit inventory depends to some extent on the shipment terms.

Picked, packed, and shipped.

Once we’ve worked out the average daily value of a shipment, we can use this to determine the cost of transportation. In-transit inventory is products that have been shipped by the seller but have yet to reach the customer. These goods are also called goods-in-transit, pipeline inventory, or transportation inventory. If we (buyer) responsible for, we should estimate the cost make accrue expenses as part of the inventory in transit. We will make accrue when we have an obligation to the supplier, so all the costs will not record at the same time with goods in transit. The buyer will respond when receiving goods, they have to record the inventory as risk and reward are transferred.

In the case of FOB destination, the seller is the owner of the goods in transit and is, therefore, liable for the shipment. But under FOB selling point, the buyer is the owner of the in-transit inventory, making them liable for the shipment. When a business is in its growing stage, sometimes it becomes challenging to manage inventory.

Is in-transit insurance a good idea?

If these goods are not accounted for correctly, it can result in an understatement of assets, which may affect the company’s liquidity ratios and overall financial stability. For instance, an understated inventory can lead to a lower current ratio, potentially signaling liquidity issues to creditors and investors. Understanding the different types of goods in transit is essential for accurate accounting and financial reporting. These categories determine when ownership and risk transfer from the seller to the buyer, impacting how transactions are recorded. After a long discussion, we know exactly when to record inventory, which depends on our contract with the seller.

- Adhering to GAAP or IFRS ensures reporting aligns with standards for matching revenue with related expenses.

- This process involves tracking items that are being transported from the seller to the buyer but have not yet reached their final destination.

- The shipping fees are recorded on the buyer’s books for FOB shipping point and on the seller’s books for FOB destination.

- By having inventory on the way, your customers can order items that may have been out of stock otherwise.

For example, the employee recording shipments should not be the same person reconciling inventory records. Authorization protocols for shipping and receiving goods further strengthen controls by ensuring all transactions are properly vetted. Point to be noted that in practical the buyer may not record inventory until it arrives at the receiving deck. Since 2016, Qoblex has been the trusted online platform for small and medium-sized enterprises (SMEs), offering tailored solutions to simplify the operational challenges of growing businesses. With a diverse global team, Qoblex serves a customer base in over 40 countries, making it a reliable partner for businesses worldwide.

tips for efficient in-transit inventory management

Here, 3PL service providers like Shiprocket Fulfillment can be the best go-to option. They not just help manage inventory but also pick, pack, and ship orders on your behalf. With their expertise, they can process orders with utmost accuracy and decrease shipping errors.

Other important decisions, like where to store inventory, also depend on a well-managed inventory flow. Follow Khatabook for the latest updates, news blogs, and articles related to micro, small and medium businesses (MSMEs), business tips, income tax, GST, salary, and accounting. Or, if you intend to get shipping insurance but your policy states that in-transit inventory is owned by the customer, you’ll need to update your policies.

The goods in transit actually have a place with the group (parent and subsidiary); hence, the balance must be in the consolidated balance sheet. In case the purchaser is answerable for it, at that point he should assess the expense to make accrue costs as a component of the goods in transit. Nevertheless, another concern is the goods in transit valuation, which should be perceived in the balance sheet. Subsequently, there will be a contrast between the dealer and the buyer’s book attributable to the terms of shipment.

Many times, the goods are moving from a wholesaler to an ecommerce retailer (who then becomes a reseller). This phrase is primarily used by the company that’s responsible for selling and shipping the product. The advent of advanced tracking technologies has revolutionized the management of goods in transit, offering unprecedented visibility and control over the supply chain. Real-time tracking systems, powered by GPS and IoT (Internet of Things) devices, enable businesses to monitor the exact location of their shipments at any given moment.

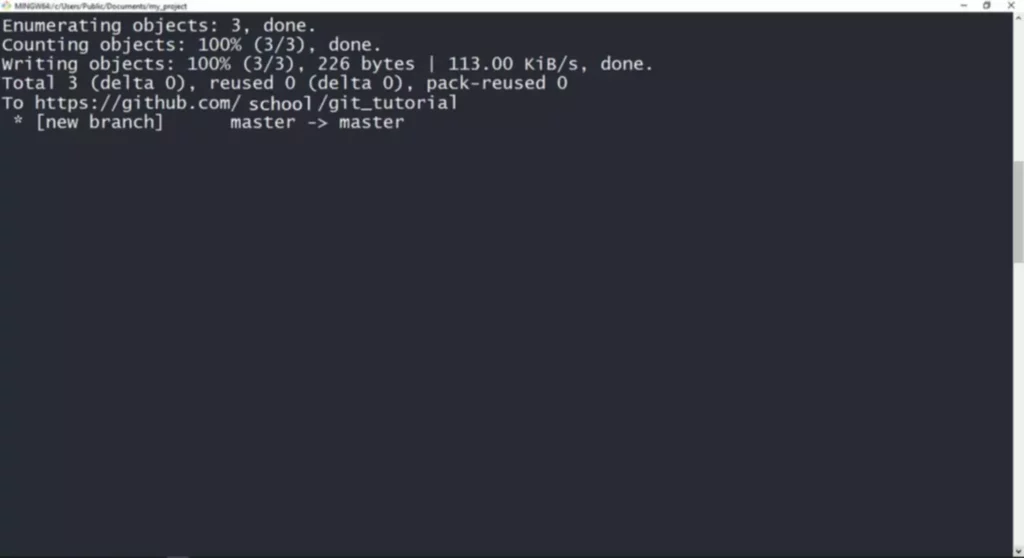

The only thing that changed is that the pre-fixed agreement for the delivery FOB was on the destination, not the shipping point. Tracking customer orders, updating stock levels, and completing assemblies are just three of the menial tasks you can automate with inventory in transit accounting inventory management software. In-transit inventory is a frequently overlooked aspect of inventory management and accounting for product businesses. We break down what it is, how to calculate its value, plus a few tricks for smarter management of in-transit goods. Let’s assume that both a company (seller) and its customer (buyer) have accounting periods which end on December 31. The company ships a truckload of merchandise on December 30 to a customer who is located 2,000 miles away.

This misstatement can have a cascading effect, influencing operating income and net income, thereby affecting the overall financial performance of the company. Alternatively, the title is passed on to the buyer if the sale occurs before the goods are shipped. So, in case the buyer arranges for the shipment, the sale and purchase are immediately recorded in the books. Ownership of in-transit inventory typically depends on the shipping terms agreed upon (e.g., FOB Origin or FOB Destination). These terms dictate when ownership transfers from the seller to the buyer, affecting liability and responsibility during transit. By following these best practices, you can enhance your management of in-transit inventory, reduce risks, and improve overall supply chain performance.

This method is particularly advantageous for sellers as it allows them to recognize revenue earlier. However, it also places the risk of loss or damage during transit on the buyer, necessitating careful consideration of insurance and logistics arrangements. Efficiently managing goods in transit is crucial for businesses to maintain accurate financial records and ensure smooth operations. This process involves tracking items that are being transported from the seller to the buyer but have not yet reached their final destination.

Here, ABC Inc. is the dealer and XYZ Inc. is the buyer, however, the terms of conveyance have been changed to FOB destination, and the shipment still has to arrive at XYZ Inc.’s. As a presumable possibility, these items can remain disregarded during the way toward representing overall stock as such products are not genuinely available at both the buyer’s or the vendor’s place. Goods in Transit indicates the stock that is bought from the purchaser and delivered through a dealer, nonetheless, the merchandise is in transit but still needs to arrive at the proposed buyer.