A Beginner’s Guide to Forex Day Trading

Forex day trading can be an exhilarating way to generate profits in financial markets. For newcomers, understanding the basics of currency trading is crucial before diving in. With a fast-paced nature and potential for high returns, it’s no wonder many are attracted to this field. In this guide, we will explore essential concepts and tips for successful Forex day trading, helping beginners navigate the complexities of the market. For those seeking local options, you may want to consider forex day trading for beginners Best Ugandan Brokers to get started.

Understanding Forex Trading

The Forex market, or foreign exchange market, is the largest financial market in the world, with billions of dollars traded daily. It operates 24 hours a day, five days a week, across major financial centers around the globe. Unlike traditional stock markets, Forex trading involves exchanging one currency for another, with the aim of making a profit from fluctuations in exchange rates.

The Basics of Day Trading

Day trading is a strategy where traders buy and sell financial instruments within the same trading day, oftentimes making numerous trades in one day. This approach allows traders to take advantage of small price movements in highly liquid stocks or currencies. For Forex day traders, this generally involves entering and exiting positions quickly, often holding onto them for mere minutes to a few hours.

Essential Terminology and Concepts

- Pips: A pip is the smallest price change in a currency pair. Understanding pip movements is crucial for calculating gains and losses.

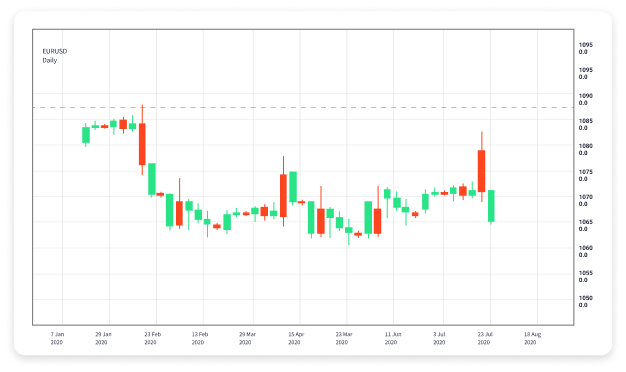

- Trading Pair: In Forex, currencies are traded in pairs such as EUR/USD or GBP/JPY. The first currency is the base currency, and the second is the quote currency.

- Leverage: Forex trading often involves leverage, allowing traders to control larger positions with a smaller amount of capital. While this can amplify profits, it also increases potential losses.

- Bid/Ask Price: The bid price is what buyers are willing to pay for a currency, while the ask price is what sellers are asking. The difference between the two is called the spread.

Choosing the Right Broker

Selecting a reputable Forex broker is vital for day trading success. Look for key features such as low spreads, fast execution speeds, and a trading platform that suits your needs. Make sure to choose a broker that is regulated and has positive reviews from other traders.

Developing a Trading Strategy

A well-defined trading strategy is essential for consistent success in day trading. Here are a few guidelines to develop your own strategy:

- Set Clear Goals: Define what you want to achieve through day trading. Are you looking for supplementary income, or do you aspire to trade full-time?

- Analyze Markets: Employ technical analysis using charts to identify price patterns and trends, while also considering fundamental analysis for broader market influences.

- Risk Management: Never risk more than you can afford to lose. Consider using stop-loss orders to limit potential losses on trades.

- Stay Disciplined: Stick to your trading plan and avoid emotional decisions. This is crucial for long-term success.

Key Strategies for Day Trading

There are several strategies that day traders can employ, each with its own advantages:

- Scalping: This strategy focuses on making small profits from many trades throughout the day, usually involving holding positions for just seconds or minutes.

- Momentum Trading: Traders identify currencies showing strong trends and enter positions to ride the wave, often using news or events to time entries.

- Range Trading: This involves identifying key support and resistance levels and trading within that range, buying at the support level and selling at the resistance level.

Tools and Resources

Utilizing the right tools can significantly improve your trading experience. Here are some essential tools for Forex day traders:

- Charting Software: Software like MetaTrader or TradingView offers advanced charting capabilities, allowing traders to analyze price movements effectively.

- Economic Calendar: Keeping track of economic news and events can provide insights into potential market movements.

- Trading Journal: Documenting trades, strategies, and emotions can help traders reflect on their performance and make necessary adjustments.

Psychological Aspects of Day Trading

Successful day trading isn’t just about strategies and tools; it’s also about your mindset. Traders must manage emotions effectively to avoid overtrading or panicking during loss-making trades. Maintaining discipline, patience, and a strong risk management approach can help mitigate the psychological stresses of trading.

Continuing Education

The Forex market is always changing, and it’s crucial for traders to keep learning. Consider joining trading communities, attending webinars, or reading books tailored for Forex day trading. Staying informed about market trends and strategies can set you up for long-term success.

Conclusion

Forex day trading offers a unique opportunity for those looking to engage in dynamic market activity. For beginners, understanding the fundamentals, developing a solid strategy, choosing the right broker, and managing risks are critical steps to take before embarking on this exciting journey. With commitment, discipline, and a willingness to learn, you can navigate the world of Forex day trading successfully.